It's astonishing that homeownership in California has actually stabilized in the last couple of years. How does anyone there find someone to sell them a mortgage in this atmosphere?

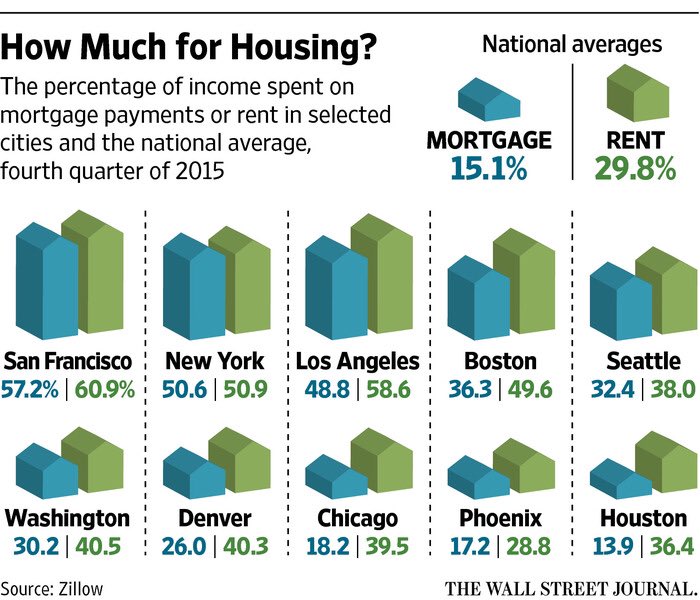

How to make city housing more affordable (Hint: build more) https://t.co/jMi4M6ksEy pic.twitter.com/wUTkplIOI8

— Nick Timiraos(@NickTimiraos) April 25, 2016

Best thing from Frank-Dodd and the Consumer Financial Protection Bureau, Qualified Mortgageshttps://t.co/vLqeW1EsTm pic.twitter.com/jvBG4yBZpU

— John Wake (@JohnWake) April 25, 2016

Sorry if you've already covered this (occasionally miss a piece), but thought you'd find the slide show interesting http://econlog.econlib.org/archives/2016/04/market_urbanism.html

ReplyDeleteYeah. Those are some nice looking properties, aren't they?

DeleteSheesh, it looks hopeless. In Los Angeles they are ranting they want no more development. They needs forests of 50-story condo towers.

ReplyDeleteProperty zoning does not work.

Ben, if they fixed transportation to justify the added traffic I would be for relaxed zoning laws. But they don't want to.

DeleteBy the way, Kocherlakota apparently does not understand helicopter money. He says treasury bonds would have to be issued. But Lonergan says base money is issued with no bonds involved.

Gary-- I think running a federal deficit while simultaneously conducting QE is a helicopter drop. But I seem to be out in left field on this issue.

ReplyDeleteWell, according to Lonergan, Ben, a real helicopter drop does not involve treasury bonds at all. It is not a tax break. It is not a fiscal policy. It is purely a monetary policy. I wrote about Lonergan's precise definition of helicopter drop here: http://www.talkmarkets.com/content/bonds/eric-lonergan-precisely-defines-helicopter-money?post=92811

DeleteIt is far better than QE, because it is a real stimulus, not just swapping out bonds for excess reserves. Kocherlakota does not understand it or chooses not to. Bernanke doesn't even get it quite right.

Can you imagine these people ran our monetary system?