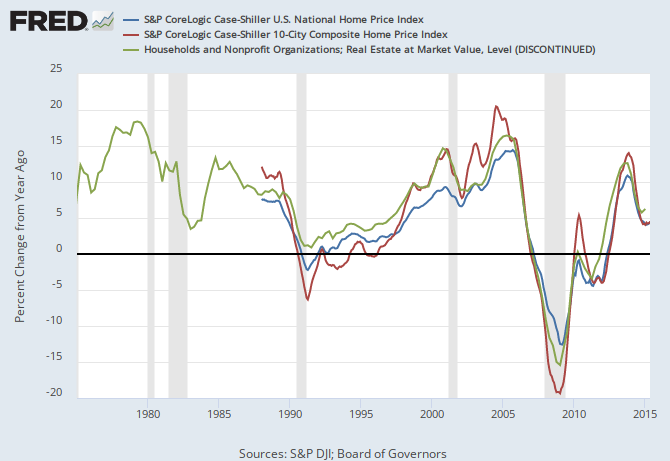

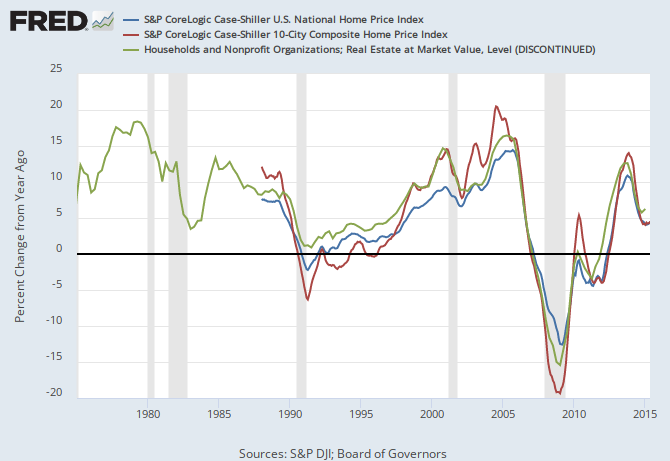

I think the data bears this out - housing keeps pretty efficiently to no arbitrage pricing. But, before I get to the data, I just want to note that this shouldn't be controversial. Even though it is usually put in terms of homebuyer demand ("We get a housing bubble when mortgage rates are low and homebuyers expect prices to go up."), this is basically saying the same thing ("Expected home returns will converge with mortgage rates.")

I like to start with the BEA and Fed Flow of Funds data. From the Fed, we can get the market value of owner-occupied housing and outstanding mortgages. From the BEA (table 7.12) we get owner-occupier housing expenditures, including an estimate of depreciation. One of those expenses is net interest, which, divided by outstanding mortgages gives us an aggregate estimate of mortgage interest rates. The BEA also gives us net rental income after all expenses and depreciation. Rental income plus net interest expense, divided by total home market values, gives us the aggregate total return to home ownership.

Here is a graph of those measures. Mortgages are a nominal security, but housing returns are real. In other words, future mortgage payments are fixed, but net rent to the homeowner will rise with inflation. So, expected inflation is embedded in the mortgage interest payment while the mortgage principal remains fixed, but for the homeowner, rent and the property value inflate over time. So, expected inflation is the difference between the interest rate on mortgages and the return to the homeowner.

Here is a graph of those measures. Mortgages are a nominal security, but housing returns are real. In other words, future mortgage payments are fixed, but net rent to the homeowner will rise with inflation. So, expected inflation is embedded in the mortgage interest payment while the mortgage principal remains fixed, but for the homeowner, rent and the property value inflate over time. So, expected inflation is the difference between the interest rate on mortgages and the return to the homeowner.I like using these measures, but we quickly run into problems. First, most mortgages have a fixed rate, so the interest rate here is somewhat backward looking. But, even solving this problem would not solve all of our inflation issues. There is a difference between expected inflation premiums and experienced inflation. Since a mortgage is nominal and a home is real, owning a leveraged home is taking a long position on inflation. So, during periods of unusual inflation fluctuations, the real returns on homes remain fairly level, but the gains and losses on their short mortgage position are substantial. This makes measuring the reliability of no arbitrage pricing difficult. It would be nice if I had a long historical data set of real long term bond rates.

|

| Source : accuracy of real rate, from most to least is: green, red, purple. |

Here is a graph that compares the 30 year mortgage rate to my measure of housing yields to arrive at an alternate measure of inflation premiums.

Here is a graph that compares the 30 year mortgage rate to my measure of housing yields to arrive at an alternate measure of inflation premiums.

|

| The blue line is the inflation premium implied by the effective aggregate interest rate paid by homeowners. |

This may not seem like a big deal. These are, admittedly rough measures, so the error bands implied by my visualizations are pretty broad compared to the ranges of each variable. But, it is important to also consider the counterfactual. One thing I think we can say here with confidence is that the idea that home buyers are not operating within typical models of financial tradeoffs and that home prices can be pulled into the stratosphere by naïve and hopeful buyers is not remotely supported by the data.

One way to think of the inflation premium measures in these graphs is that they represent the level of inflation that completely leveraged homeowners would need to experience in order to avoid capital gains or losses on the real value of their mortgage principal. Or, put another way, if mortgage rates and home yields are, indeed, arbitraged through efficient markets, this inflation premium represents the inflation that the marginal homebuyer expects to see. So, if home prices were being bid up to unreasonable levels because of over-optimistic speculators, we would see that inflation premium rise.

Some critics of the housing boom reference survey data where homebuyers appear to have very optimistic expectations about future home values. But, what we can see here is that these expectations did not factor in the home prices. Home prices during the boom did not depend on excess rent inflation for their valuations. Implied inflation was 2% to 3% during the boom. The counterfactual that seems to be widely believed is that the inflation expectations that buyers used to justify home prices during the boom was as much as 10% or more. There is no evidence for that at all.

To look at this a little more closely, here is a graph of the difference between the spot rate of 30 year mortgages and the effective aggregate rate paid by homeowners. The effective rate tends to be more stable and the spot rate is more cyclical. In the 1970s we can see the spot rate climb as inflation spiked, while many homeowners retained their existing mortgages with lower rates. We don't tend to see this separation when rates are decreasing because owners can refinance at lower rates. In the inflation graph above, we can see that the inflation premium implied from the BEA data actually declined in the 2000s. In other words, home prices became especially conservative during that period. Home prices were justified, even if rent inflation began to subside.

To look at this a little more closely, here is a graph of the difference between the spot rate of 30 year mortgages and the effective aggregate rate paid by homeowners. The effective rate tends to be more stable and the spot rate is more cyclical. In the 1970s we can see the spot rate climb as inflation spiked, while many homeowners retained their existing mortgages with lower rates. We don't tend to see this separation when rates are decreasing because owners can refinance at lower rates. In the inflation graph above, we can see that the inflation premium implied from the BEA data actually declined in the 2000s. In other words, home prices became especially conservative during that period. Home prices were justified, even if rent inflation began to subside.Looking back at this graph of mortgage rates, the effective rate dipped during this time. So, it could be that effective rates were declining because of teaser rates, ARMs, and generally shorter durations. If we adjust for that, the effective rate might be closer to the running inflation rate, but it clearly was not above it.

|

| Source |

So, the higher required inflation implied by 30 year mortgage spot rates signals conservative bankers as much as it signals optimistic home buyers. The trend toward shorter duration and floating rate mortgages after 2003, as with so many pieces of evidence here, can fit in both a "bubble" story and a reasonable efficiency/arbitrage story.

In either case, homebuyer expectations were within the range of trend inflation.

This inflation premium gives us another way to look at the notion that if we didn't have artificial barriers to homebuilding, shelter inflation would converge with core or broad consumer inflation over time. This is because mortgage investors would arbitrage mortgage rates with other bonds. Rent inflation would have little relevance to them, in terms of interest rates. Compared to the rate on real bonds, mortgage investors would require an inflation premium reflecting broader incomes and consumption.

But for homebuyers, the inflation premium that would be important would be rent inflation. It would be changing rent inflation that would change the income of their investment from their original expectations.

In an unencumbered market, if shelter inflation and broad inflation deviated, home supply would expand until they converged. If shelter inflation was high, home buyers would be enticed to buy homes on leverage, funding new building, which would pull down rents until the inflation rates converged. In addition to an arbitrage between nominal and real returns on investments, there would be a natural arbitrage between rent inflation and broader inflation.

But, since large segments of the real estate market in many large cities are incapable of market-based supply responses, this arbitrage has been playing out through price much more than through quantity. The rising prices are a measure of this inefficiency. If housing supply markets were efficient, it would take very small price adjustments to create supply reactions. The end result of rising rents would be new building that led to subsequently falling rents. But, since some large markets have housing supply that is very inelastic, home prices must rise until real yields on homes fall enough to bridge the gap between the two inflation premiums. This also means that when there are sharp supply constraints, in a market with efficient demand homebuyers will rationally be led to take on higher leverage, because the supply constraint will provide persistent arbitrage profits. Could the rise in mortgage spreads after 2003 reflect caution from the banks? Perceived risk resulting from the moderation of rent inflation that happened briefly while home building was at its peak, which led mortgage rates to rise, so that banks were claiming some of the profits available from the inflation arbitrage?

A point of distinction to think about here is the difference between rent inflation and home price inflation. The surveys of the optimistic homebuyers tend to relate to home prices. Housing rents tend to be much more stable. But home prices are based on a complex, very long duration security. In a housing market that has reasonable valuations, as we see in the measures above, homeowners could reasonably expect double digit price increases for several years if local rent inflation is not expected to abate. This sort of price behavior is not unprecedented, and we should expect it to be especially possible in today's environment where metro area supply constraints are especially bad, and naturally low real interest rates make intrinsic values especially volatile.

A point of distinction to think about here is the difference between rent inflation and home price inflation. The surveys of the optimistic homebuyers tend to relate to home prices. Housing rents tend to be much more stable. But home prices are based on a complex, very long duration security. In a housing market that has reasonable valuations, as we see in the measures above, homeowners could reasonably expect double digit price increases for several years if local rent inflation is not expected to abate. This sort of price behavior is not unprecedented, and we should expect it to be especially possible in today's environment where metro area supply constraints are especially bad, and naturally low real interest rates make intrinsic values especially volatile.Real yields on homes were just over 2% at the top of the boom, and were in line with long term real treasuries. Rent inflation had been running at about 3% compared to broad inflation at closer to 2%. Home values become undefinable - infinite - if those inflation levels sustainably diverge by 2 1/2%, matching the real yield. Now, there may be reasons why that wouldn't happen, but there is a lot of space between a few years of 10% price gains and infinity.

As for the period since 2007, arbitrage has failed. Homeowners now don't require any rent inflation to justify home prices. Any rent inflation is an excess gain for them. And rent inflation is now running at 3%.