Up until 2006, housing restrictions in the Closed Access cities explains it all, and after 2006, constraints in the mortgage credit market explain it. A year is too long to wait to get this out. I have never been more excited about these results.

Then, I see this paper, which had slipped my attention before now. (HT: John Wake) From the abstract, regarding causes of local home price appreciation:

none of the demand-shifters analyzed show positive pre-trends, but some such as the share of subprime lending, do lag the beginning of the boom. This suggests that key players in the lending market more responded to the boom, rather than caused it to start.

Yes, yes, and yes. I have ceased being surprised by new information that undermines the credit causation story, but I never thought that in the process of writing the book things would be coming together this well.

By the way, in the Ferreira & Gyourko paper linked above, in cities where home prices moved up, guess what factors had the strongest significance at both the neighborhood and MSA level? Mortgage rates before the break, migration before the break (only available at MSA level), and homebuyer incomes during and after the break.

________________________________

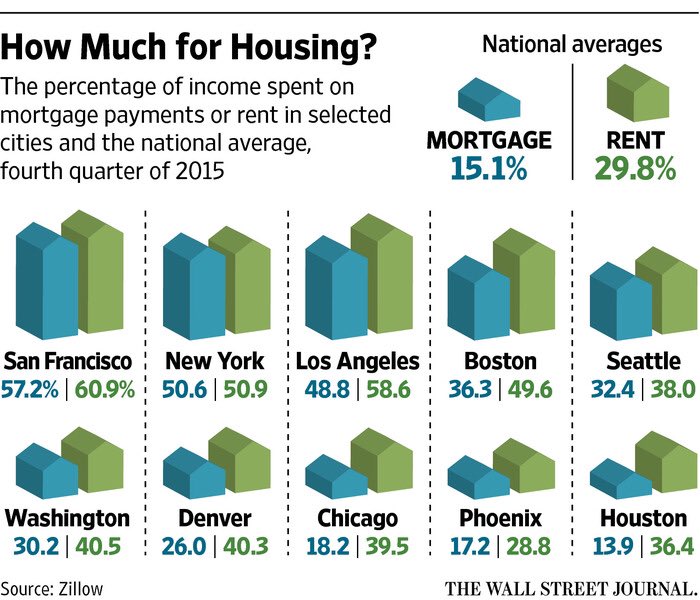

Here is some data by using IRS and Zillow numbers for over 15,000 zip codes.

First, here is a histogram of log incomes, before and after tax, relative to the US median. And the composition of these distributions really is direct. In other words, Closed Access housing policies basically mean that the hump from the middle of the gross income distribution has been picked up and moved to the low end of the distribution of incomes after rents.

First, here is a histogram of log incomes, before and after tax, relative to the US median. And the composition of these distributions really is direct. In other words, Closed Access housing policies basically mean that the hump from the middle of the gross income distribution has been picked up and moved to the low end of the distribution of incomes after rents. We can see that in the next graph, in which there are dozens of zip codes with relatively normal gross incomes where rents are extremely high. These are the Closed Access zip codes. These are the zip codes where the middle class is getting squeezed.

We can see that in the next graph, in which there are dozens of zip codes with relatively normal gross incomes where rents are extremely high. These are the Closed Access zip codes. These are the zip codes where the middle class is getting squeezed.This is only half the story. Since discretion about housing consumption increases with income levels, high income households in the Closed Access cities have similar relative rent expenses to Open Access cities, but as income levels decline, the ability to reduce housing consumption also declines.

This actually gets somewhat complicated, because incomes across Closed Access cities are inflated by the effects of limited access on wages. So, those households in the red circle have incomes before rent that are higher than they would be in an Open Access regime, but incomes after rent that are lower than they would be in an Open Access regime. This is the source of the migration pattern we are seeing out of the Closed Access cities. High income households that can leverage their skills in those labor markets with inflated incomes and also can reduce their real housing consumption, move in, and low income houses get squeezed until some decide to pick up their lives and move away. They are willing to put up with some economic stress before involuntarily moving to another city, so the incomes of lower-middle class households that remain tend to be low, after adjusting for cost. And, when a household does move, their gross income tends to fall, even though their discretionary income after rent will tend to rise.

The other half of the story are those inflated incomes that come from Closed Access. Maybe the easiest way to think about it is that those middle class and lower middle class households that move away to Open Access cities are actually normalizing their incomes. Those high income households in the Closed Access cities have inflated incomes. If the Closed Access cities built millions of new housing units, the top end of the income distribution, both before and after costs, would pull back.

The supposed hollowing out of the middle class is entirely a result of this migration pattern. There is no signature of this phenomenon within the Open Access cities. The reason that the national distribution of incomes looks like there is a hollowing out of the middle class is because the migration pattern through the Closed Access cities produces a bunch of high income households with inflated incomes and a bunch of middle income households that raise their discretionary incomes by lowering their gross incomes, through migration.

I think this graph allows us to visualize the mutual economic trade-off that happens through this migration. The high income household, moving from, say 11.5 to 12 in log income (roughly moving from $100,000 to $160,000) by tapping into local labor networks, reduces their housing consumption in order to capture that income, so they move up and to the right in our graph. The household migrating away might be moving from 10.5 to 10.25 in log income (roughly $36,000 to $28,000). But in the process, they can actually move into materially better housing while gaining discretionary income. They move up and to the left.

Unfortunately, Zillow rent data only goes back to 2010. I suspect that this problem was less pronounced before 2006, because the option of migrating was accommodated by the housing boom. Since there are fewer outlets for mitigating this dislocation now, the pain that existing Closed Access residents are willing to take before it triggers a move to an Open Access city is probably larger. This means that the migration pattern has declined since 2006 and incomes after rent have been pushed further from the norm in Closed Access cities.

This is a problem. A household has been forced to move away from their chosen home against their will. But, as a nation, we are battling a bunch of hobgoblins here, creating an incredible amount of additional economic damage, when the cause of these problems is primarily in this one factor - Closed Access housing. I don't have high expectations that this problem can be solved, soon if ever. But, at least the rest of us can stop going on witch hunts and start dealing with the problem in ways that have utility. In fact, the main thing we have accomplished is that we have removed the option for a lot of these lower-middle class households to increase their incomes after costs by migrating, because we have now created Closed Access housing tendencies throughout the country by hamstringing the mortgage market.

I have no doubts now about the strength of the narrative I am writing. I feel extremely fortunate that I have found myself in the position to tell this story. My main concern is that the damage we have inflicted has been so severe and so explicit that many people will react defensively. To really believe my story, you need to realize that, lacking a solution to the Closed Access housing problem, the banks were accommodating relief and that supporting mortgage and housing markets would have been key to a stable and growing middle class. To someone who has been down on the streets marching with Occupy Wall Street protesters, or who has been giving support to those movements - to someone who has been demanding retribution against bankers - to accept the story I am telling requires eating a lot of crow. It would be hard enough to just make the argument that all of the culture war / class warfare stuff that populates political discourse is insignificant and that the solution lies outside the tribal score-settling that motivates us. I would expect that argument to fail to win hearts and minds. But, I have to go further than that, and say that, to believe my story is to accept that the policies that have been practically universally demanded, with anger and indignation, have caused untold economic damage. We have been fighting an unjust war.

I have been really lifted up by the support I have received from those who have seen the story so far. But, the cognitive dissonance this should create in many potential readers will be deep, and I am afraid that the reactions to that will be fierce and ugly. I'm not sure I am ready for that.

The story needs to be told. But I am not looking forward to standing in front of the pitchfork wielding mob to claim that the witches were innocent.

Follow up.