"Philip Lowe: National wealth, land values and monetary policy"

Address by Mr Philip Lowe, Deputy Governor of the Reserve Bank of Australia, to the 54th Shann Memorial Lecture, Perth, 12 August 2015.Mr. Lowe's commentary is mostly devoted to Australia, but the issues apply just as well to the U.S., and, in fact, I think the universality of these issues in developed economies may explain how problems that originate in localized housing politics may have aggregated into a problem that affects global fixed income markets. Much of Mr. Lowe's discussion builds around this issue:

This isn't quite the case in the U.S. It should be, but we threw our housing sector into disequilibrium in 2007. Australia didn't. But, even before that, it looks to me like housing only accounted for more like half of the increase in wealth to GDP in the U.S. I suspect that one reason is that foreign corporate investments are a larger portion of U.S. wealth. This doesn't show up so much in book values in the U.S. capital account, but it does show up in the market value of U.S. corporations. The first factor he cites in raising those prices is lower inflation and less financial regulation. I had originally intuited that as a significant factor in rising home prices, myself, before I began this series of posts. I outlined Friday why I don't think the data confirms that intuition. In addition to the confounding pieces of evidence I discussed in that post, I have discussed previously how rising home square footage is another piece of evidence that looks at first blush like it is a sign of overbuilding, but may actually be a result of supply constraints. Since I wrote that post, I have come to that view even more strongly, since the concentration of those supply constraints in the core cities should cause an even larger substitution of square footage for lot size.almost three-quarters of the increase in the ratio of net wealth to GDP since the late1980s is explained by higher land prices.

Lowe continues:

The second factor is the combination of strong population growth and the structural difficulties of increasing the effective supply of residential land....They include the challenges of developing land on the urban fringe and of rezoning land close to city centres for urban infill. They also include, in some areas, underinvestment in transportation infrastructure. This underinvestment has effectively constrained the growth in the supply of “well-located” land at a time when demand for this type of land has grown very strongly. The result has been a higher average price of land in our major cities. Another possible structural explanation is that the higher land prices reflect an upward revision to people’s expectations of future income growth and thus the amount they are prepared to pay for housing services. One possible reason for this is that the growth of our cities generates a positive externality – by bringing more people together competition is improved and productivity is higher. While this might be part of the story, I think it is unlikely to be a central part. Real income growth per capita did pick up markedly from around the mid 1990s, but it has subsequently slowed substantially, with apparently little effect on the price of land relative to income. So the story is really one of increased borrowing capacity, strong population growth and a slow supply response.

....work done by my colleagues at the Reserve Bank of Australia (RBA) has estimated that a rise in wealth of $100 leads to a rise in non-housing spending of between $2 and $4 per year. (11)....Interestingly, other colleagues at the RBA have recently been examining this idea, again using household level data from the HILDA Survey.13 They find clear evidence in favour of a collateral channel, especially for younger households who are more likely to be credit constrained. In contrast, they find no evidence in favour of the traditional pure wealth effect. Instead, their evidence is consistent with the alternative expected-income idea. Perhaps, the most intriguing aspect of their results is that when housing prices in a particular area increase, renters in that area increase their consumption. The increase is not as large as for owner occupiers, but it is an increase. The conclusion that my colleagues reach is that it is a common third factor such as higher expected future income, or less income uncertainty, that is, at least partly, responsible for the observed association between housing wealth and spending.

That last point is interesting, and I think ties in with this NBER paper from Hsieh and Moretti that I recently discussed, which suggested that housing constraints in high productivity cities cause some of that productivity to be captured as economic rents by laborers and real estate owners in the city. The Windsor, Jääskelä and Finlay paper he cites finds that when home prices rise, there is no measurable wealth effect that leads to growth in consumption. Instead there is some credit expansion for credit constrained households and there is, surprisingly, increased consumption for both owners and renters, which they take as a signal of increased income expectations. (I think we could also say that the credit expansion, in the aggregate, is related to positive future income expectations.) I think it is plausible that the base causal factor here, given a city with high or increasing productivity, could be the housing constraint, which limits labor inflows to the city, pushing up wages and real estate rents. This would lead to higher real estate rents and values, and to higher income expectations, credit usage, and consumption from both renting and owning households.

To the extent that labor movement is flexible, these rents should eventually accrue mostly to real estate owners. This should happen most readily among low income households who benefit the least (in absolute terms) from the city's productivity opportunities and who spend a larger portion of their incomes on rent. I think this fits well with the common observation that urban real estate is being developed only for the ultra-rich. That is because very high income workers are still claiming some of the rents of the limited access city, and the process of building new high end real estate is the process of real estate owners claiming more of those rents. Thus, the largest beneficiaries of urban policies that dis-incentivize building and require more low rent building are probably the city's very high income wage earners. This is because their marginal housing consumption is more discretionary, so they can reduce their real housing consumption to retain more of the available rents. I wonder if this is why the priciest units seem to be purchased by what Krugman referred to as "domestic malefactors of great wealth, but also oligarchs, princelings, and sheiks", because the very high income households who are in the city for productive reasons would be reducing their housing consumption during their tenure in the high-cost city - possibly downsizing their urban space and pairing it with a spacious home in the country. The constricted supply turns the highest rent units into very effective luxury status goods.

I am starting to wonder how much of the measured trends in income inequality have their source in the housing policies of the major cities. I think there was generally an expectation that the technological revolution would make location less important. But, we have found that for the creative functions behind that technology, location has become more important. And, globally, cities have developed housing constraints that have prevented them from accommodating the inflows of creative and productive workers who find value there. Lowe mentions the importance of transportation. Will the trends in income distribution reverse when the self-driving car becomes widely available?

In the meantime, I think Lowe has missed an important implication of these various findings. He doubts that the higher value of urban real estate has come from higher expected incomes. He says, "Real income growth per capita did pick up markedly from around the mid 1990s, but it has subsequently slowed substantially, with apparently little effect on the price of land relative to income." But this is because real incomes are lowered by the rising rents themselves. Income expectation in the cities are, indeed, strong. But the rising incomes are eventually claimed by real estate owners.

Distributional Effects of Home Price Changes

In an economy without supply constraints, rent and home prices should rise with inflation over the long run. In this case, rising income expectations should coincide with higher real interest rates, and future real increases in housing consumption would come from future increases in the real value of the housing stock. This is actually a good description of the housing market of the 1990s, when rent inflation wasn't excessive (until the last half of the decade) and price/rent ratios were low. So, I think the positive correlation of income growth expectations and home rents and prices is only operative in a constrained supply context. Or, to restate this in a more narrative way, without supply constraints, households with rising incomes wouldn't pay more to rent or purchase homes; they would just build better homes to add to the beginning housing stock. In that case, there wouldn't be a correlation between rising incomes and rising rents or prices of the existing housing stock.

Here, I would like to pull in the recent paper from Song, Price, Guvenen, and Bloom at the LSE. They found that essentially all of the change in income inequality since 1982 has happened between firms. In other words, distribution of incomes within firms has been relatively stable. The highest income workers aren't earning relatively more than their co-workers than they used to. Rather, workers of all incomes at the highest paying firms are making more than workers at other firms.

Some of this could be explained, I think, by changing firm structures. For instance, Apple's corporate structure outsources much of the lower value-added positions. More generally, technology-related fields have largely developed around human capital, more than physical capital, leading to firms filled with high income professionals and entrepreneurial development-oriented technology workers. But Song, et. al. seem to find that the pattern holds when controlling for industry type, worker age, gender, and tenure, firm size and region, and is stable over the time period.

I have included the graphs by region here. The x-axis on the graphs is the income percentile of the worker. The blue line is the change in income for workers in each percentile from 1982 to 2012. The red line is the amount of that change that can be explained by the average income of the firms the workers in that percentile worked for, and the green line is the amount of that change that can be explained by the change in incomes for that percentile, relative to their co-workers.

When the data is separated by region, there are distinct bumps in the bottom 30% of incomes. Except for the very lowest wage earners, these workers saw rising incomes compared to their coworkers. We see the opposite pattern at the top of the wage scale, though not generally as pronounced, where high income workers saw their incomes rise slightly less than their co-workers, except for a slight positive bump for the top 1%.

Some of this must be related to organizational shifts. Maybe there is an explanation for the hump at the low end of wages related to the shift from manufacturing to health & education and leisure & hospitality. I wonder if there is generally a bit of a rural vs. urban divide here, and that the distribution of firm wage gains would be flatter if we applied location specific inflation adjustments.

A careful viewing of the scales of these graphs shows that the West and Northeast regions have much sharper divergence between the top 15% of firms and the rest of the firms - a divergence of earnings growth between high income firms and other firms of about .4 compared to .2 in the other regions. These are the regions where the cities with the worst housing problems are located (NY, San Francisco, San Jose).

The urban housing supply issue may be a fundamental driver for all of these issues - income variance, the sense that we are in a "bubble" economy where income gains are soaked up by rising asset prices, the sense that real incomes for the lowest income earners are stagnant.

More Distributional Effects of Home Price Changes

Let me define a static housing context as one where interest rates are stable, and the real housing stock is expanded at the rate of real income growth, so that each year, households spend the same portion of their incomes on housing, and they increase the real value of their homes (through size, location, etc.) as their incomes grow.

Now, if long term real interest rates decline, this simply reflects a change in the price that current savers have to pay for a claim on future rents. This is a transfer from future buyers to current owners. There are some distributional effects here, but only between owners. High long term real rates probably promote economic mobility by allowing new savers to more easily pre-pay future rent and by reducing the nominal value of past savers. But, there is no first-order effect on home consumption (rent). This explains some of what has happened over the past 20 years or so.

But, all else equal, what if there is a shock to expected future housing supply? This will also cause home prices to rise, but now, this isn't simply a transfer of cash from buyers to sellers. In this case, the buyers are actually buying more rent. One way of thinking about it is that a single property now represents a larger portion of the future housing stock than it did in our beginning stasis condition. This is similar to buying stock in a firm with that has an above average growth rate because it is gaining market share. It fetches a higher price, just as the home now fetches a higher price. At the point of recognition of this change, home owners will receive a one-time capital gain. This is like owning shares in a firm that announces a positive product development. Or, maybe, more precisely, it is like owning shares in a firm that announces protectionist developments - say, the value of a domestic tire manufacturer after a large tire tariff is announced.

In that scenario, the ability of securities markets to pull future developments into the current price creates something that looks like a disconnect to a naïve observer. Rent isn't forward looking. It reflects the current supply and demand for housing consumption. So, the higher home price will appear to be inflated. But, since the home itself is a static property, it's value relative to a given future housing stock is static. A new owner must purchase that home's portion of the future housing stock, whether they want to or not. If housing consumption continues to command a stable portion of total consumption expenditures, as it has for more than 50 years, then there may be conceptual value to thinking about home values in terms of future housing "market share".

Thinking about it this way, adding potential supply will reduce the value of existing homes by reducing their future expected housing "market share". I have wondered how much the lack of available investment in real estate has been a contributing factor to lower real long term interest rates. But, I wonder if this presents another way of thinking about that. Normally, risk free real interest rates would tend to rise and fall with expectations for real economic growth. So, current low real interest rates suggest low growth expectations.

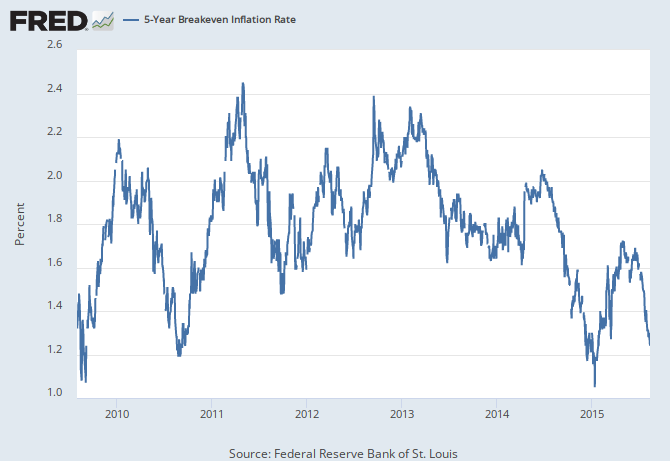

I wonder if this is related to the current tendency for home prices to rise to unusual levels. The expected growth of the housing "market share" of individual home owners is basically a claim on future nominal income growth. It is the result of artificial limits on housing expansion - limits to real growth, which operate as growing claims by real estate owners on future nominal incomes. The added value of home ownership and lower expected future real income growth expectations are two sides of the same coin.

This is sort of an application of limited access vs. universal access. A universal access economy will lead to creative destruction and growth, and real risk free interest rates will reflect the related optimism. A limited access economy will lead to rent-seeking, and real risk free interest rates will reflect stagnation. A large portion of our economy (housing) is characterized by limited access - first through urban building policies, which pushed real interest rates down slightly in the 2000s, then through limited mortgage access policies, which pushed real interest rates down to the extremely low levels seen since the 2008 crisis.